U.S. renewable, grid battery projects battle transformer shortage

American developers constructing renewable energy projects, grid battery projects, and power storage for grids are facing significant hurdles in obtaining crucial components, resulting in increased expenses and project delays.

Supply chain disruptions have severely constrained the availability of high-voltage transformers necessary to link wind and solar farms as well as batteries to the grid, pivotal to the energy transition.

The extensive lead time required for the delivery of these transformers, which often need to be custom-built and can be as large as a truck, has compelled some project developers to order equipment even before securing commercial agreements to sell power from these projects, as highlighted by Vanessa Witte, senior energy storage analyst at Wood Mackenzie. Consequently, developers find themselves taking substantial risks, gambling on securing deals and approvals essential for project viability.

“This is an incredibly risky situation,” Witte emphasized.

Ben Pratt, CEO of Nova Clean Energy, a utility-scale project developer in Chicago, noted that delivery times for transformers and associated equipment have extended from 50 weeks a year ago to 150 weeks presently. Pratt stressed the necessity of transparent communication with buyers of renewable project power, acknowledging the challenges in meeting initially projected commercial operation dates due to these delays.

Some larger developers foresaw these challenges and preemptively amassed transformers and associated equipment before the surge in demand triggered by measures like the Inflation Reduction Act (IRA), signed into law in August 2022, aimed at accelerating the deployment of renewable energy. Reagan Farr, CEO of Silicon Ranch, a solar farm developer, revealed having spent over $100 million in stockpiling transformers and switchgears to brace for these supply issues.

The IRA’s enactment, providing significant green energy tax credits, spurred an already anticipated spike in demand, prompting developers who hadn’t pre-ordered equipment to face substantially higher costs and extended lead times for delivery.

Also Read About –

Permitting Reform for Clean Energy Projects in New York and California

In addition to transformers, large-scale battery projects aimed at grid energy storage and stabilizing the intermittency of wind and solar power are experiencing prolonged lead times. Andrew Waranch, CEO of Spearmint Energy, noted that these projects are taking 12 to 18 months to complete, about six months longer than anticipated due to supply chain issues. However, he indicated a slight improvement from the 100-week completion time observed during the summer.

The shortage of key electrical engineering equipment such as transformers and substation equipment remains a primary bottleneck for most developers, as highlighted by Waranch.

Despite efforts by developers, the supply-demand gap remains stark. Wood Mackenzie and the American Clean Power Association reported a lower-than-expected addition of 1,510 megawatts of grid-scale battery storage in the second quarter due to these supply chain disruptions.

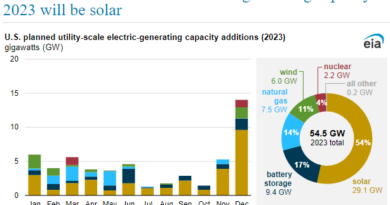

Looking ahead, the industry anticipates adding 9,400 megawatts of battery storage capacity this year, nearly doubling the existing total. However, Swiss-based Energy Vault and utility AES Corp (AES.N) are preparing for longer timelines and higher costs to mitigate the impact of these delays.

Manufacturers have pointed to persistent challenges in sourcing raw materials like electrical steel, aggravated by factory shutdowns in China during the pandemic and exacerbated by export restrictions imposed on Russia after the Ukraine conflict. Consequently, the industry faces difficulties in rapidly scaling up production to meet soaring demand, as highlighted by Doug Banty, president of MGM Transformer.

John Darby, president of Niagara Transformer, echoed these sentiments, citing the reluctance of U.S. producers to expand capacity swiftly due to the associated expenses.

Source – https://www.reuters.com/